Navigating the Challenges of Rising Healthcare Costs

As a midsize business owner, you’re all too familiar with the relentless pressure of rising healthcare costs. It’s a challenge that’s squeezing your bottom line and leaving you with little control over one of your most significant expenses. You’re not alone in this struggle – businesses of all sizes are grappling with the same issue, searching for a way to regain stability and long-term savings.

But what if there was a solution that could help you take back control of your healthcare costs, while still offering robust benefits to your employees? Enter the world of group medical captives – a strategic approach that’s transforming the way midsize employers manage their healthcare expenses.

Defining the Captive Advantage

Before we dive into the specifics of group medical captives, let’s first understand the broader concept of captives. A captive is an insurance company that’s set up and owned by a business or a group of businesses. Instead of purchasing traditional insurance, the business uses its own captive to finance its risks. This model allows for greater control over underwriting, claims management, and ultimately, cost control.

While many businesses may be familiar with captives in the context of workers’ compensation or property and casualty insurance, group medical captives are a specialized form that focuses specifically on managing healthcare expenses. These captives are created when a group of midsize employers join forces to pool their resources and self-insure their medical claims.

The Power of Pooled Resources

Imagine a scenario where five midsize companies come together to create their own insurance company – one that gives them the power to manage healthcare costs and claims directly. This is the essence of a group medical captive. By pooling their resources, these employers benefit from the “law of large numbers,” which states that the larger the number of lives independently exposed to loss, the greater the probability that the actual loss experience will equal the expected loss experience.

In other words, the more data you have, the more predictable your healthcare costs become. This is a game-changer for midsize employers, who often struggle with the unpredictability of healthcare expenses, making it challenging to self-fund their plans.

How Does a Group Medical Captive Work?

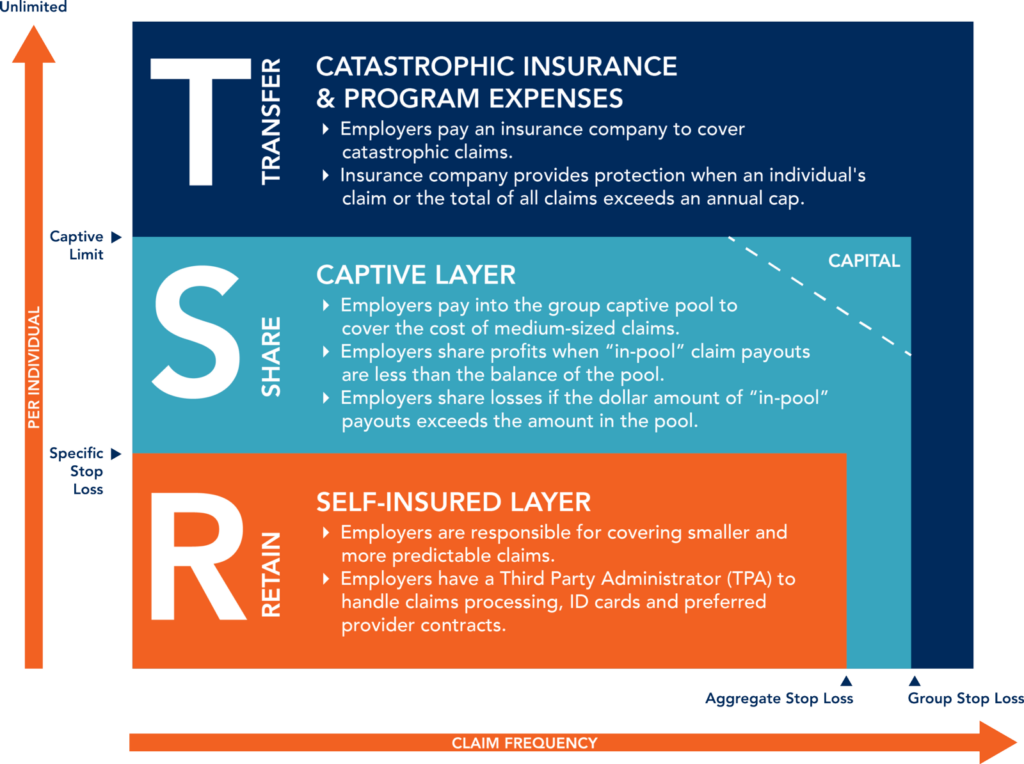

The structure of a group medical captive is designed to provide a multi-layered approach to risk management, ensuring robust protection from losses and maximizing cost-effectiveness. Let’s break down the key components:

The Claims Fund

- This is the primary fund where employers pay for everyday, predictable claims. Routine medical expenses are handled directly from this reserve, keeping common costs in-house.

The Captive Layer

- Beyond the claims fund, employers contribute additional capital to a pooled captive fund. This shared risk layer is designed to absorb claims that exceed the capacity of the claims fund but remain within expected or moderate levels.

- By pooling these funds across multiple employers, the captive layer enhances risk sharing and leverages combined buying power, reducing the frequency and severity of claims that need to be escalated further to stop-loss insurance.

The Transferred Risk Layer

- For catastrophic claims that exceed both the claims fund and the captive layer, stop-loss insurance is employed. This “transferred risk layer” covers infrequent, high-severity events.

- Because the everyday and moderate claims are managed by the claims fund and the captive layer, the stop-loss insurance only needs to cover a smaller portion of the risk, resulting in significantly lower stop-loss premiums.

The Benefits of a Group Medical Captive

By leveraging the power of pooled resources and a multi-layered risk management approach, group medical captives offer a range of benefits that can be transformative for midsize employers:

Increased Cost Predictability

- The larger data pool in a captive structure leads to greater predictability in healthcare costs, allowing employers to better plan and budget for their expenses.

- This stability can be a game-changer, as the unpredictability of healthcare costs is often a significant barrier to self-funding for midsize businesses.

Enhanced Cost Control

- By managing claims and risk directly, employers in a captive have more control over their healthcare spending, allowing them to implement targeted cost-containment strategies.

- The collective buying power of the captive also enables better negotiation with service providers, such as third-party administrators, pharmacy benefit managers, and stop-loss insurers.

Tailored Solutions

- Group medical captives are designed to meet the unique needs of their member employers, providing a customized approach to risk management and healthcare plan design.

- This flexibility allows employers to address their specific challenges and priorities, rather than being limited by a one-size-fits-all insurance plan.

Long-Term Savings

- By retaining more of the risk within the captive structure and reducing the need for traditional insurance, employers can achieve significant long-term savings on their healthcare costs.

- These savings can be reinvested into the business, employee benefits, or other strategic initiatives, helping to drive growth and competitiveness.

Who is Eligible for a Group Medical Captive?

While group medical captives are a powerful solution, they are not a one-size-fits-all approach. Captive partners typically evaluate a range of criteria when assessing potential members, including:

Employer Size

- Typically, employers in a group medical captive will have a minimum of 50 employees on their health plan.

Funding Strategies

- Most captives welcome employers who are already familiar with self-funding or level-funding their healthcare plans, as they have a better understanding of the discipline and management practices required.

Claims History

- Captives will often request 2-3 years of claims data to evaluate the risk profile and potential fit of the employer.

- This can be challenging for fully insured employers, as they may not have direct access to their claims history.

Key Considerations for Joining a Group Medical Captive

Before jumping into a group medical captive, there are several essential questions you should ask to ensure it’s the right fit for your organization:

Captive Management Expertise

- What are the qualifications and experience of the captive manager? Ensure they have the necessary expertise to navigate the regulatory landscape and manage the captive effectively.

Risk Sharing

- How is the risk shared among the captive members? Understand the structure and the mechanisms in place to distribute risk and ensure fairness.

Financial Stability

- What is the financial stability and performance history of the captive? Evaluate the captive’s track record to ensure it’s a sound and sustainable solution.

Claims Management

- How will claims be managed, and what support will be provided? Ensure the captive has robust processes and resources to handle claims efficiently.

Costs and Fees

- Are there any hidden fees or additional costs associated with joining the captive? Understand the full financial implications to avoid surprises.

Cost Containment Partners

- Who are the captive’s cost containment partners, and how do they contribute to the overall savings and efficiency of the program?

Unlocking the Potential of Group Medical Captives

If you’re a midsize business struggling with unpredictable healthcare costs and limited control, group medical captives could be the game-changing solution you’ve been searching for. By pooling resources with like-minded employers, you can gain the stability, cost control, and tailored solutions needed to manage your healthcare expenses effectively.

As your partner in healthcare risk management, we’re here to guide you every step of the way. Reach out to learn more about how a group medical captive could fit your organization’s needs and unlock the power of this transformative approach.

To get started, request your Health Risk Scorecard today.

It’s the first step towards a healthier, more sustainable healthcare strategy for your business.

Don’t let your benefits plan hold you back. Contact BeneSmart today for a tailored strategy that scales as fast as you do. Check out our other videos to learn more about transforming your health insurance strategy:

- How to Reduce Health Insurance Costs by 20% or More

- The Hidden Costs of Traditional Health Insurance

- 5 Strategies to Reduce Health Insurance Costs

And be sure to subscribe to our channel at @BeneSmart for more insights on optimizing your health insurance strategy.

Ready to get started? Reach out to us at quotes@benesmartservices.com or contact me directly at rich@benesmartservices.com. Let’s work together to build a benefits plan that can keep up with your growth.

Connect with me on LinkedIn: https://www.linkedin.com/in/richardwestermayer/

To learn more about BeneSmart’s innovative solutions and how they can help your business, check out our YouTube channel, https://www.youtube.com/@BeneSmart

Don’t forget to subscribe @ https://www.youtube.com/@BeneSmart to stay up-to-date on the latest trends and strategies in the world of benefit expense management.Ready to take the first step? Reach out to Rich Westermayer https://www.linkedin.com/in/richardwestermayer/ at rich@benesmartservices.com to get started on your own transformative journey.