Think back to the last time you were watching a football game on primetime or maybe Dancing With the Stars or The Bachelor, there is a pretty good chance you saw at least a few commercials from drug manufacturers. You know, the ones that have the laundry list of possible side effects. These drugs are the money makers for big pharma.

These drugs also pose a threat to the long term success of your group health plan. Typically, RX claims account for anywhere from 15-25% of your total claim spend in a health plan, with the rest coming from medical claims. This is according to various reports in the marketplace.

Rx spend can include injections, patches, oral medications, and even sometimes intravenous (IV) treatments that can be administered by the patient and is available through a pharmacy or a Pharmacy Benefit Manager (PBM).

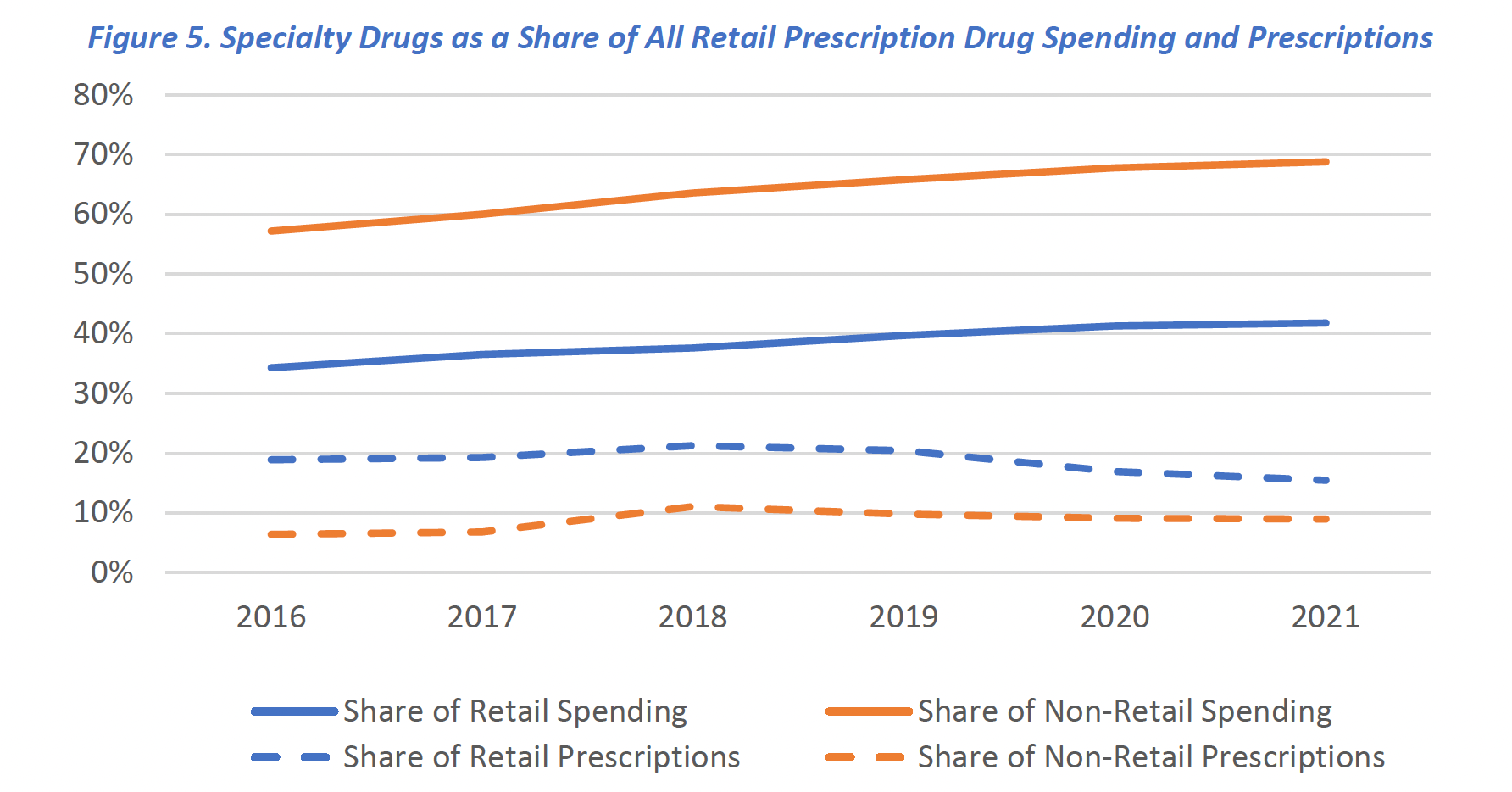

The more alarming statistic however, is that speciality meds while only prescribed to 2% of the total population, account for over 50% of RX claim spend. That tells us one thing, these drugs are not cheap.

The cost of specialty drugs has continued to grow, totaling $301 billion in 2021, an increase of 43% since 2016, according to a report from the Department of Health and Human Services.

Specialty drugs contribute significantly to prescription drug costs. As mentioned earlier, they often have high price tags, which can further impact the proportion of claim spend attributed to prescription medications.

The chart below illustrates the inverse nature of specialty prescriptions to the share of spending.

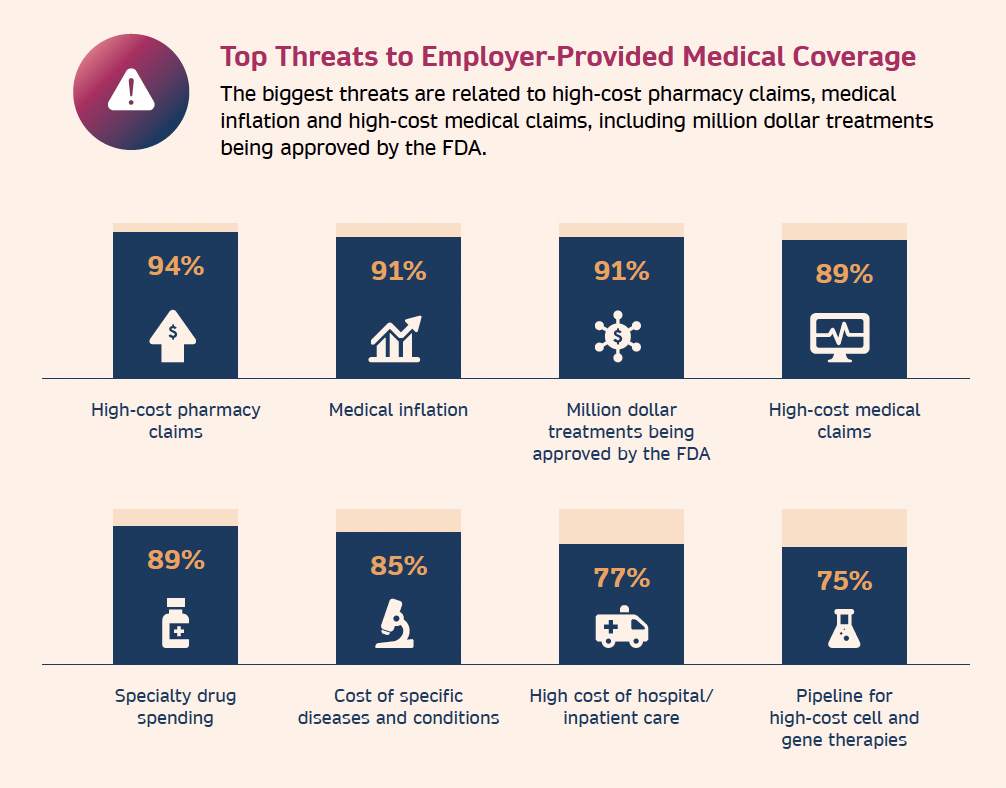

Self-insured employers view the cost of specialty drugs as a major challenge in providing health benefits, according to a survey released by the Midwest Business Group on Health (MBGH).

But it’s not just self-insured employers that are exposed to this threat. This problem extends beyond a self-insured plan to level-funded and fully-insured health plans as well.

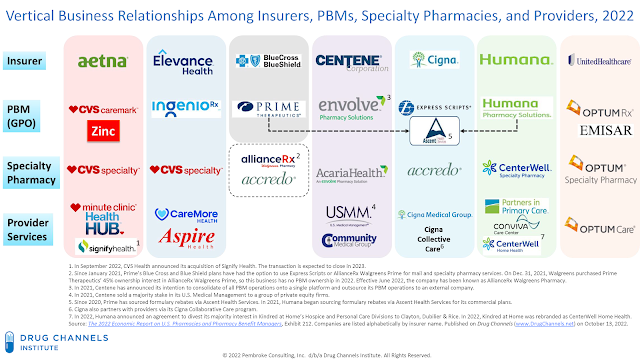

Top Threats to Employer-Provided Medical CoverageThe problem lies in vertical integration of the most well known health insurers. This is a business strategy where a company expands its operations by acquiring or merging with companies that are involved in different stages of the same supply chain or industry.

Top Threats to Employer-Provided Medical CoverageThe problem lies in vertical integration of the most well known health insurers. This is a business strategy where a company expands its operations by acquiring or merging with companies that are involved in different stages of the same supply chain or industry.  Vertical Integration

Vertical Integration

As an employer, what can you do to protect yourself from these threats?

The first step is to start working with an independent PBM which we talked about in last weeks article, Low Hanging Fruit, How a new PBM can save your health plan money

The next step is to make sure that your PBM or your health plan is utilizing a speciality drug sourcing program.

How does a specialty drug sourcing program work?

The first thing to understand is that there are entire organizations that exist to help health plans of all size find alternative ways to procure these high cost drugs. These organizations do not exist in a fully-insured health plan, a carrier level-funded health plan or in the ASO self-funded plans. There is just too much profitability in these drugs for the health insurer to allow these types of programs to be a part of your health plan.

There are two main avenues that these vendors work to achieve savings for your health plan when it comes to high cost drugs. The first is known as a manufacturers assistance program or simply MAP. The second is through international sourcing.

Qualifying for a MAP for a specialty drug typically involves meeting specific eligibility criteria set by the manufacturer. These programs are designed to provide financial assistance or other support to individuals who may have difficulty affording the high cost of specialty medications. The specific requirements can vary among manufacturers and programs, the most common factors used to establish whether or not someone qualifies are going to be based on household size and income relative to the size of household.

International drug sourcing refers to the practice of procuring pharmaceutical products from foreign markets, at lower costs, to help reduce healthcare expenses. This always comes secondary to the MAP program and is utilized when the member makes too much money to qualify for the MAP program. The drugs are sourced from tier 1 pharmacy countries, like Canada, New Zealand, Australia and the United Kingdom.

These are two of the most popular strategies being used to lower the risk of a health plan being hit with these high cost speciality med claims.

Where do you go from here?

Start by asking questions. Does your health plan allow for you to choose your own PBM vendor? How does the PBM handle speciality drugs? What programs are in place to reduce exposure?

To gain accurate and up-to-date information on the percentage of claim spend from prescription drugs in your specific group health plan, it would be necessary to analyze the plan’s claims data. We have many trusted vendors that would be happy to provide you with a pharmacy savings analysis.